How to Get a ₹1 Lakh Pension Per Month?

Introduction

₹1 lakh per month has become a benchmark aspiration for retirement planning. It represents a lifestyle that covers inflation-adjusted living costs, healthcare, and long-term adequacy. Achieving this is realistic for anyone who plans early and stays disciplined. The National Pension System provides a structured way to build this long-term corpus through regulated, diversified, market-linked investing.

In this blog, we'll explain how to get a ₹1 lakh monthly pension using NPS annuity and MSF with UTI Wealth Builder for higher retirement corpus with disciplined investing.

The NPS Structure

NPS works through two account types:

- Tier I account is mandatory for retirement and provides tax benefits.

- Tier II is an optional savings account with no withdrawal restrictions.

Flexible investment approach:

NPS provides various investment options across different asset classes:

- Equities (E)

- Government Bonds (G)

- Corporate Debentures (C)

Subscribers can select their investment approach via:

Active Choice

- Equity (E): Up to 100%

- Corporate Bonds (C): Up to 100%

- Government Securities (G): Up to 100%

Auto Choice

There are four Life Cycle Fund Options for Auto Choice based on risk tolerance:

- Life Cycle 25 – Low (5E / 55Y)

- Life Cycle 50 – Moderate (10E / 55Y)

- Life Cycle 75 – High (15E / 55Y)

- Life Cycle – Aggressive

Withdrawal in NPS

At retirement: Up to 80% of the accumulated corpus can be withdrawn as a lump sum, which is exempt from tax under Section 10(12A).

Annuity income: The remaining minimum 20% of the corpus must be used to buy an annuity, and the pension received from this annuity is taxable as per the subscriber’s applicable income-tax slab.

Tax Benefits Under NPS

- Section 80C: Deductions up to ₹1.5 lakh per year on contributions (under the old regime)

- Section 80CCD(1B): Additional deduction of up to ₹50,000 over and above the 80C limit (under the old regime).

- Section 80CCD(2): Employer contribution deductible—up to 10% of salary (basic + DA) under the old regime and up to 14% under the new regime, subject to the overall ceiling of ₹7.5 lakh. For government employees, the employer's contribution is deductible up to 14% under both regimes.

Secure a ₹1 Lakh Monthly Pension with Annuity

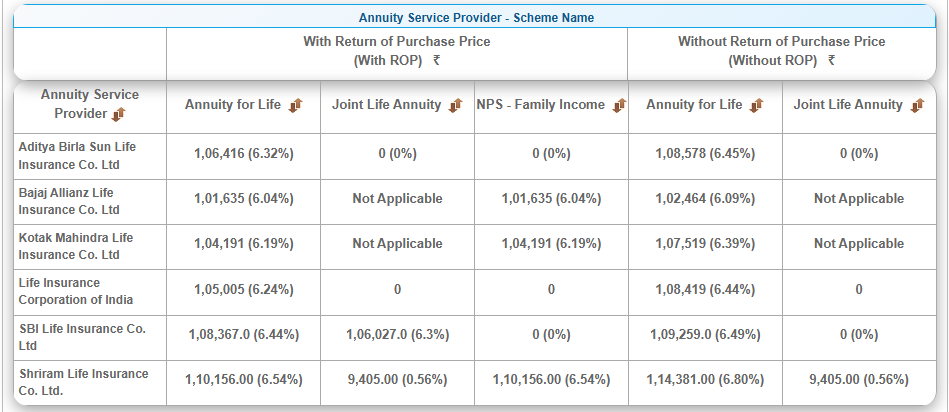

An annuity in NPS converts a portion of your retirement corpus into a regular post-retirement income, ensuring financial stability and predictable cash flow for life after you exit the system. It acts as a safety net, complementing the lump-sum withdrawal for a secure and sustainable retirement.

With that said, here is an in-depth breakdown of how to achieve it with the power of annuity:

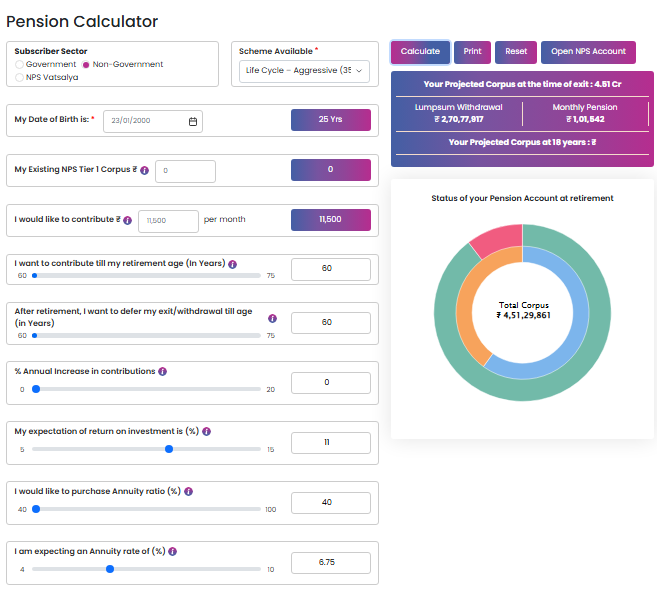

Subscriber Profile

- Subscriber sector: Non-Government

- Age of the subscriber: 25 Years

- Retirement age: 60 years

- Exit and withdrawal assumed at age 60

This implies a long investment horizon of approximately 35 years, which is critical for compounding to work effectively.

Investment Structure

- Scheme selected: Life Cycle Aggressive (35E / 55Y)

- Annuity purchase ratio at exit: 40%

- Lump sum withdrawal at exit: 60%

- Expected annuity rate at retirement: 6.75%

The Life Cycle Aggressive option allows higher equity exposure in early years, gradually reducing risk as retirement approaches.

NPS Calculation Explained

- Monthly contribution: ₹11,500

- Contribution period: Till age 60

- Expected return on investment: 11%

- Annuity allocation at retirement: 40%

These assumptions reflect a long-term growth expectation aligned with aggressive life cycle exposure.

The Smart Way to Get ₹1 Lakh Pension Monthly With MSF

The Multiple Scheme Framework, MSF, is an NPS structure that allows investors to invest in differentiated investment strategies within the same PAN, based on risk preference and long-term retirement goals.

UTI Pension Fund under MSF

UTI Pension Fund introduced two MSF schemes:

- UTI Pension Fund Wealth Builder MSF, focused on higher growth through equity exposure

- UTI Pension Fund Dynamic Asset Allocator MSF, designed for balanced growth through diversified asset allocation.

Benefits of investing in MSF schemes

- Clear choice between growth-oriented and balanced strategies

- Upto 100% equity exposure

- Better alignment with individual risk appetite and retirement horizon

- Professional fund management across distinct portfolios

- Potential for long-term retirement corpus creation within NPS

Multiple Scheme Framework (MSF) Investment Assumptions

All profile-related assumptions remain the same. The key differences are the size of the contribution and the expected rate of return. Under MSF, the expected return increases from 11% to 13% due to 100% equity exposure, investments in mid-cap stocks, and equity tapering rule with age

NPS Calculation Explained

- Monthly contribution: ₹7,200

- Contribution period: Till age 60

- Expected return on investment: 13%

- Annuity allocation at retirement: 40%

- Expected annuity rate: 6.75%

MSF Advantage – Projected Pension

At retirement (60 Years) total invested value is 29,44,800 while the total corpus is ₹5.04 Cr.

Now up to 60% of the accumulated corpus can be withdrawn as a lump sum, giving around ₹3.02 crore, while the remaining corpus provides a monthly pension of ₹1,00,000+

Comparison of Common Scheme-Lifecycle Aggressive and MSF - UTI Wealth Builder

| Parameters | Common Scheme - Lifecycle Aggressive | MSF with UTI Wealth Builder |

|---|

| Monthly contribution | 11,500 | 7,200 |

| Total invested amount (Till age 60) | 47,03,500 | 29,44,800 |

| Expected return on investment | 11% | 13% |

| Equity exposure | Upto 75% | Upto 100% |

| Final Corpus | ₹4.51 Cr | ₹5.04 Cr |

The difference becomes quite evident, even with varying contribution levels. Common Scheme requires ₹11,500 per month to build a corpus of ₹4.51 crore at an expected return of 11% and equity exposure up to 75%, MSF needs only ₹7,200 per month and can generate a higher corpus of ₹5.04 crore due to 13% expected returns and up to 100% equity exposure.

This highlights MSF can be a more growth-oriented retirement solution.

A key takeaway: MSF with UTI Wealth Builder demonstrates how strategic asset allocation and higher equity participation can significantly improve long-term wealth creation. Even with a smaller monthly investment, MSF has the potential to deliver a higher retirement corpus, making it a compelling option for investors seeking aggressive, growth-oriented retirement planning.

Conclusion: Achieve ₹1 Lakh Pension Per Month by Investing Smartly

Achieving a ₹1 lakh monthly retirement income requires strategy, discipline, and time. By combining NPS with the Multiple Scheme Framework, you can personalise your retirement plan, diversify across growth and risk-managed schemes, and optimise long-term wealth creation. MSF allows you to align your portfolio with your risk appetite and life stage, while NPS ensures disciplined contributions, long-term market participation, and tax efficiency.

Start early, stay consistent, and use MSF to balance growth and stability—this approach gives you the best chance to reach your ₹1 lakh goal. Take control of your retirement today with UTI Pension Fund and design a structured, personalised plan that turns your long-term aspirations into reality.

Visit your nearest UTI Pension Fund branch or www.utipension.com to open your NPS account today. For more assistance, get in touch with us at contact@utipf.co.in, and our team will be happy to assist you at the earliest.