SIP in NPS: A Game Changer for Every Smart Investor!

Introduction

In today’s fast-changing financial landscape, building long-term wealth requires discipline, consistency, and thoughtful planning. A Systematic Investment Plan (SIP) enables investors to contribute a fixed amount regularly, benefiting from rupee cost averaging and the power of compounding. While SIPs are commonly linked with long-term financial planning, adopting a SIP-like approach within the National Pension System (NPS) can be equally powerful for retirement planning, as it encourages steady investing and reduces the impact of market volatility.

By investing in NPS through regular, systematic contributions, individuals can gradually build a robust retirement corpus while avoiding the risks of market timing. Starting early allows investments to compound over decades, transforming small, consistent contributions into meaningful retirement wealth. SIP in NPS therefore offers a structured, long-term, and tax-efficient way to secure financial stability in retirement.

About National Pension System (NPS)

The National Pension System (NPS) is a government-backed, voluntary retirement savings scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA). It helps individuals accumulate a retirement corpus through market-linked returns and long-term compounding. (Source: PFRDA)

SIP-style investing in NPS encourages subscribers to contribute regularly, build a corpus gradually, and reduce the challenges of timing the market.

Key Benefits and Features of SIP in NPS

- Flexible Contribution Frequency: Choose monthly, quarterly, or yearly contributions based on your cash flow.

- Disciplined Retirement Investing: Regular SIP-style contributions help build a strong retirement corpus through consistent and structured savings.

- Automated Investing: Set up standing instructions via your bank for hassle-free contributions.

- Power of Compounding: Early and consistent contributions allow your retirement wealth to grow exponentially.

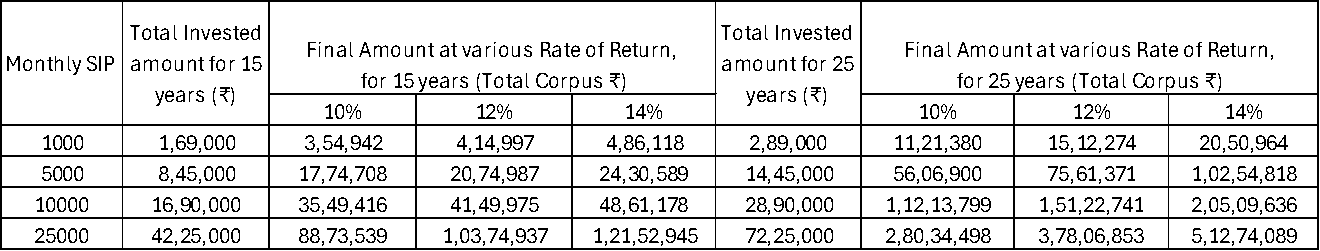

*Source - NPS Trust Calculator; Scheme - Lifecycle - Aggressive (35E/55Y)Balance

- Long-Term Financial Security: Designed specifically for retirement, NPS ensures stable and regulated wealth creation over time.

-

Tax Benefits: SIP contributions enjoy the same tax deductions under:

- Section 80CCD(1): Under the old tax regime, you can claim up to ₹1.5 lakh (within the overall 80C limit) on your NPS contributions. Under the new regime, this deduction is not available.

- Section 80CCD(1B): An additional ₹50,000 deduction is allowed under the old regime for your NPS contributions. This is disallowed under the new tax regime.

- Section 80CCD(2): Under the old regime, enjoy tax benefits of up to Rs. 1.5 lakh under Section 80C, up to Rs. 50,000 under Section 80CCD(1B), and up to 10% of (Basic + DA) under Section 80CCD(2). Under the new regime, Section 80CCD(2) offers benefits of up to 14% of (Basic + DA). Conditions apply.

-

Diverse Investment Options

Allocate investments across:

- Equity (E)

- Corporate Debt (C)

- Government Securities (G)

Subscribers can select their investment approach via:

Active Choice

- Equity (E): Up to 100%

- Corporate Bonds (C): Up to 100%

- Government Securities (G): Up to 100%

Auto Choice

There are four Life Cycle Fund Options for Auto Choice based on risk tolerance:

- Life Cycle 75 - High (15E/55Y)

- Life Cycle 50 - Moderate (10E/55Y)

- Life Cycle 25 - Low (5E/55Y)

- Life Cycle Aggressive (35E/55Y)

Subscribers can change the pension fund once a year.

Withdrawal Rules

SIP contributions in NPS follow the same withdrawal rules as regular NPS investments:

How to Apply for SIP in NPS

Step 1: Register for an NPS account from UTI Pension Fund at https://www.utipension.com/sip-in-nps.

Step 2: Select your investment option: Active Choice or Auto Choice.

Step 3: Set up SIP instructions through net banking, UPI, or a debit mandate.

Step 4: Track your contributions and performance through your CRA login.

Conclusion

SIP in NPS blends the power of systematic investing with the strength of long-term retirement planning. It enables individuals to benefit from market-linked growth, compounding, and attractive tax incentives, all while building a disciplined savings habit.

Whether you’re early in your career or planning for financial independence, SIP in NPS is a smart and strategic step toward securing your retirement future.

Start your SIP in NPS today with UTI Pension Fund. Let your small, regular contributions grow into a powerful retirement corpus tomorrow.