NPS Calculator: Plan Your Retirement Savings Easily

The NPS Calculator (National Pension System Calculator) is an online tool designed to help individuals estimate their retirement savings and plan for their financial future. By entering key details such as monthly contributions, expected rates of return and the duration of the investment, users can forecast their retirement corpus and monthly pension amounts. This tool effectively combines the features of a Monthly (SIP) calculator and an annuity calculator, offering a comprehensive overview of potential returns on investments made through the NPS. It enables users to visualise how their contributions will grow over time and understand the type of pension they can expect upon retirement.

How to Use the NPS Calculator?

Using the NPS calculator is straightforward and involves a few simple steps:

- Subscriber Sector: Select your type of subscriber sector from the following category based on your employment status:

- Government: Individuals employed with the Central Government and State Government including public servants and employees of public sector companies.

- Non-Government: Individuals employed in the private sector, self-employed, or working in other non-government organizations.

- NPS Vatsalya: Minor Indian Citizens (under the age of 18) are eligible for the NPS Vatsalya scheme, operated by a parent or guardian on behalf of the minor.

- Scheme Available (Mandatory) Select your Scheme Preference based on your Sector. The following schemes are available based on the type of sector chosen:

- Government: Central Government, State Government, 100% G, LC25, LC50

- Non-Government: LC25, LC50, LC75, Active Choice, Corp CG, Balanced Life Cycle

- NPS Vatsalya: LC25, LC50, LC75, Active Choice

- Provide Your Age: Enter your current age to calculate how many years you will be contributing until retirement.

- Enter Monthly Investment: Input the amount you plan to contribute monthly to your NPS account.

- Select Expected Rate of Return: Choose an expected rate of return based on your investment strategy—this could range from conservative to aggressive, depending on your risk appetite.

Once these inputs are provided, the calculator will compute the total amount invested, expected returns, and the estimated maturity value upon retirement.

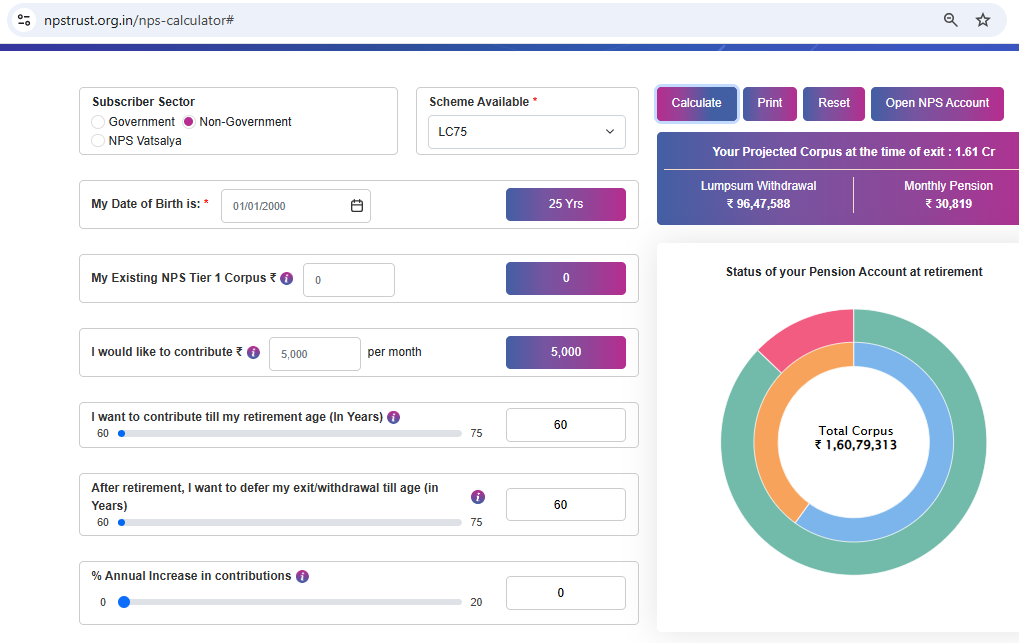

Example of NPS Retirement Saving

Consider Ramesh, who is 25 years old and plans to invest ₹ 5,000 monthly for 35 years at an expected annual return of 10%. The calculation would look like this:

- Monthly contribution (P): ₹5,000

- Assumed Annual return (r): 10%

- Investment duration (t): 35 years

- Annuity rate : 5.75%

- Total Pension Corpus at Retirement: ₹ 1,60,79,313.

- Estimated Lumpsum withdrawal (60%) - ₹ 96,47,588 and Annutiy (40%) - ₹ 64,31,725

- Estimated Monthly Pension - ₹ 30,819

- Total Invested amount - ₹ 20,00,000

Using these parameters, Ramesh can estimate his retirement corpus through the NPS calculator, which would yield substantial growth over time due to compounding.

Calculation of NPS Retirement Saving

Who Can Use the NPS Calculator?

The NPS calculator is available to all Indian citizens who are eligible to invest in the National Pension Scheme. This includes salaried individuals, self-employed professionals, and those working in the unorganised sector. The calculator is especially helpful for anyone aiming to secure their financial future through systematic retirement planning. It assists users in understanding how much they need to contribute regularly to effectively meet their retirement goals.

Benefits of National Pension Scheme Calculator

The NPS calculator offers numerous benefits that make it an invaluable resource for retirement planning:

- Easy Planning: The tool simplifies complex calculations related to retirement savings, making it easy for users to visualise their financial future.

- Personalised Estimates: Users can input their specific details, allowing for tailored projections based on their individual circumstances.

- Investment Strategy Guidance: Users can select different risk profiles—aggressive, moderate, or conservative—helping align investment strategies with their personal risk tolerance.

- Comprehensive Overview: The platform combines multiple calculations, including total investment, expected returns, maturity value, and monthly pension, all in one place.

Conclusion

The NPS calculator is a valuable tool that helps individuals take control of their retirement planning. By understanding how various factors influence their savings journey, users can make informed decisions that align with their long-term financial goals. Whether you are just starting your career or approaching retirement, using this tool can help you secure a comfortable financial future.